Sameera has fond memories of her childhood – of her father tucking her into bed with wonderful stories of magical creatures, noble kings, stalwart queens, and characters who were role models. She fondly remembers the story of the hare that outsmarted the lion who would’ve made a meal out of him. She recites this story as a song to her kids even today, to help them understand what she learned

Sameera’s Life Insurance Journey

Today, Sameera is a 40-year-old working woman who had purchased a life insurance policy as a 24-year-old. The policy, a whole life insurance plan, offers her coverage up to 99 years of age.

When in her carefree 20s, Sameera only wanted to make sure her parents could remain independent in case something was to happen to her.

By the time she was 35, her father was no more, and her mother had retired.

At 40, Sameera has a husband and 2 children.

What should she do next?

The Importance of Nomination

At 20, Sameera made her parents nominees. Luckily, they never had to claim the money. However, at 40, she should now ensure her children or husband are the nominees.

Another factor that has contributed to her financial well-being is that her father also had a life insurance policy that took care of her mother’s needs after his passing.

An important step that Sameera took after buying the policy was ensuring that the policy nomination was updated as and when necessary.

Another one was sitting down with the new nominees and explaining to them the details of the policy and what their nomination means.

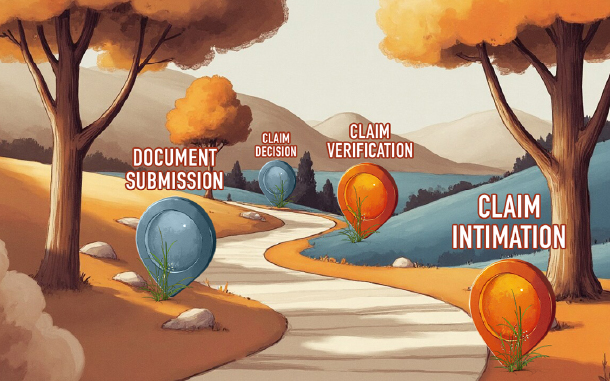

Knowing policy details is important for all nominees to ensure that the policy is claimed appropriately after the passing of the life assured, as intended by them. Nomination is a key step in many processes, such as opening a new bank account, deciding on the proceeds of your EPFO, and more. Even in life insurance, nomination is an important aspect. Some may argue that nomination in life insurance is the most crucial detail, and you should be careful about who you nominate.

What is Nomination in Life Insurance?

Nomination is a process that allows you to select and name a person to whom the benefits will be passed on. When it comes to nomination in life insurance, it is a step that allows the policyholder to select a person (or multiple people) who can claim the death benefits of their policy.

The story of Sameera teaches us why nomination in life insurance matters:

- Life changes, and so should your nominee. As your responsibilities grow, you must ensure your policy reflects those changes.

- A well-thought-out nomination secures your family’s future. Without a nominee, the claims process can become complicated for your loved ones.

- Your nominee must be informed. They should know the details of the policy and how to claim the benefits when needed.

Whether you are buying a policy with this purpose in mind, or to get other benefits from it (e.g., maturity benefits from ULIP), it is ideal to ensure that you review your life insurance nominee details regularly and change or update them whenever necessary.

Life insurance nomination is a chance for you to determine how your loved ones will support themselves after you are gone. The simple step can help you fortify your life insurance policy and ensure the benefits go into the right hands.

Sameera’s foresight in securing the future of her dependents, whether it be her parents or her children, allowed her to gain peace of mind, be more present with them, and live in the present rather than worry about their future. It also allowed her to pursue her dreams without worries of uncertainties. Like her, you can also ensure a better future for your loved ones by choosing the right nominee for your life insurance and apprising them of your policy details.