When Sudeep passed away at the age of 62, his family faced major financial challenges - not because of a lack of financial planning on his part, but because his life insurance policy did not have a nominee. Sudeep had diligently paid the premiums for his policy, but his family still had to struggle to receive the benefits of his diligence, simply because of an oversight in the nomination.

Like Sudeep, many people often overlook nominations in their financial matters. When it comes to a life insurance policy, choosing a nominee is extremely important, as the purpose of a life insurance plan is to financially support one’s family in one’s absence. The nominee is the one who initiates the claim process after the policyholder’s demise and receives the life insurance proceeds. While purchasing life insurance is a crucial step towards financial planning, overlooking the nomination aspect may lead to additional challenges after one’s demise. Keep reading to learn more.

What is a Nominee in Life Insurance?

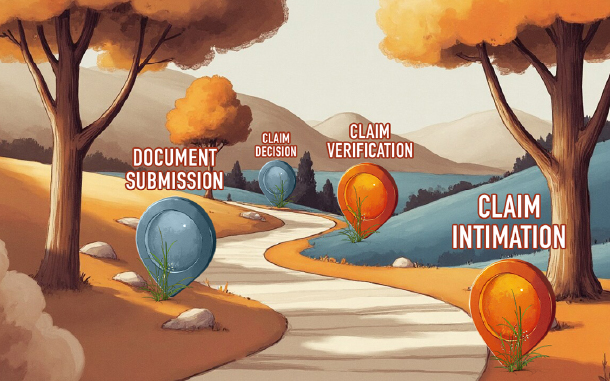

A nominee in a life insurance policy refers to the person chosen by the policyholder to receive the policy benefits in the event of the policyholder's demise. Usually, nominees are close family members like spouses, children, or parents. The nominee’s main responsibility is to raise a claim in the event of the policyholder’s demise and follow the process through to the end.

While keeping that in mind, it is also important to remember that the nominee is not always the legal heir. Legal heirs are usually next of kin, but nominees can be someone who is close to you, but you may not be legally related to. There are certain conditions to be fulfilled if you seek to nominate someone whom you are not related to.

In certain situations, where the nominee and the legal heir are different, the former might act merely as a trustee. They have to hold the proceeds until the legal heir can claim them. This distinction is all the more important to grasp in the absence of a clear nomination.

What Happens if There is No Nominee?

Like Sudeep, many may forget to add or update their nominee. What happens in such a case? Like Sudeep’s family, your family, too, may also have to face some challenges if your policy lacks a nominee.

If you have not appointed a nominee under your life insurance policy, or if the nominee is outdated, the death benefit will not go void. However, it will not be paid automatically either.

In such cases, the sum assured will be released to your legal heir/s, legal representative/s, or to the individual/s named in a succession certificate issued by a competent court.

Here, it is also important to know about a ‘beneficial nominee’, which is when a close family member is designated as a nominee. In case of legal disputes, the legal heir will not override the beneficial nominee. As per prevailing rules, the beneficial nominee will be the rightful claimant of the life insurance proceeds even in the presence of a legal heir.

However, if your nominee was a beneficial nominee and they have also passed away, the death benefit will be payable to that nominee’s legal heir/s, legal representative/s, or succession certificate holder/s, as decided by the law.

Depending on who is eligible to receive the proceeds, the following documents will be required:

Getting these documents can be time-consuming. It may take months or even years. During this period, the family might face financial hardships, which can defeat the purpose of opting for life insurance. In addition, the hassle of securing these documents and establishing their claim may also take a mental and emotional toll. Hence, it is important to have the right nominee for your life insurance policy.

What if the Nominee Dies Before the Policyholder?

If the nominee passes away before the policyholder, the latter must choose a new nominee and update the same in their life insurance plan. Failing to do so may lead to legal complications. The policy will be considered as having no nomination, and the claim process will revert to the legal heir route, as described in the above section. The eligible claimants will have to secure the required documents (succession certificate, probate of will, legal heir certificate, etc.).

Today’s insurers make it a point to ensure the policyholder chooses a nominee. However, in case of events like the nominee’s demise, it is the policyholder’s responsibility to update the nomination to ensure a smooth claim process.

What if the Nominee and the Policyholder Pass Away Together?

In unfortunate events where both the policyholder and nominee pass away simultaneously, such as in accidents, the insurer needs to determine who passed away first. In case it is difficult to find that out, the ‘commorientes’ rule comes into play, which presumes that the younger of the two survived the other.

If the nominee has passed away before the policyholder, the proceeds may go to the latter’s legal heirs. However, if the nominee passed away after the policyholder, the benefits of the policy will be given to the nominee’s legal heirs. This might not be in line with what the policyholder had intended.

To avoid this, the policyholder can also appoint multiple nominees. This ensures that the policy benefits reach the intended recipients without major legal hurdles. Having a beneficial nominee can also help avoid this.

Legal Process in the Absence of a Nominee

When a policy lacks a nominee, the claim settlement can easily become a legal process. The rightful claimant must prove their claim by obtaining several documents.

If there are multiple heirs, the process may take even more time. The heir/s will be required to provide the following documents to establish their claim:

These documents must be provided to the court of law to justify one’s claim to the life insurance proceeds.

By ensuring a clear nomination, you can avoid your loved ones from going through these legal hassles.

When you buy life insurance, you do so with the intention to secure your loved ones’ future. However, when you forget to appoint or update a nominee, it can defeat the very purpose of the policy. That is why you should ensure accurate and updated nominations. By doing so, you can provide your loved ones with financial support when they need it the most and without any legal entanglements.