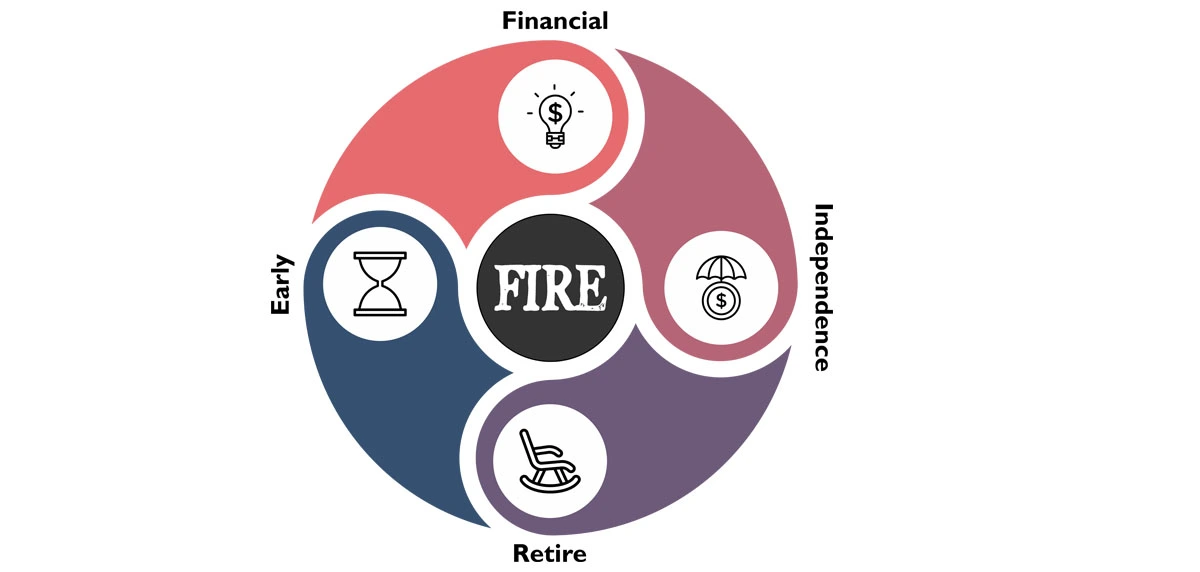

In recent years, the Financial Independence Retire Early (FIRE) movement has gained attention among those seeking to break free from traditional work structures. The concept is simple yet revolutionary: save and invest aggressively during your working years to achieve financial independence and retire much earlier than the standard retirement age. For many, the FIRE method represents a path to freedom, allowing them to prioritize their passions, hobbies, and personal goals over a lifetime of work. Let’s explore the FIRE method, its principles, variations, benefits, and challenges, and how to get started on applying it.

What is FIRE?

At its core, the FIRE method is all about achieving financial independence as early as possible. It allows individuals to retire from their job decades earlier than the norm. The method involves living below one’s means, saving aggressively, and investing wisely to build a financial cushion large enough to cover expenses indefinitely. By embracing aggressive saving, investing wisely, and adopting a minimalist lifestyle, individuals can reach their FIRE number and unlock new possibilities.

Key Principles of FIRE

The ultimate goal of FIRE is to achieve financial independence. It is the point at which your investments generate enough passive income to cover your living expenses. This independence enables you to retire early or pursue a life free from financial stress.

1. Aggressive Saving:

FIRE enthusiasts often save 50-70% of their income, far exceeding the standard savings rate of 20% or less.

2. Minimalist Living:

Reducing expenses to the essentials is a cornerstone of the FIRE lifestyle. By cutting unnecessary costs, individuals can allocate more resources toward investments.

3. Investing for Growth:

Investing in assets such as stocks, real estate, and pension schemes, can be crucial for generating the returns needed to sustain early retirement.

4. FIRE Number:

The "FIRE number" is the amount of savings required to achieve financial independence. It is typically calculated by multiplying annual expenses by 25, based on the 4% rule (withdrawing 4% annually from investments).

How Does FIRE Work?

The FIRE method is simple to understand but requires discipline to implement. The individual needs to spend less, save more, and invest early. To achieve the goal of ‘financial independence retire early’ or FIRE, individuals usually tend to build an investment corpus that can generate passive income sufficient to cover all living expenses for an indefinite period. This approach allows one to maintain financial security without depending on active employment.

The process begins by calculating total annual expenses and determining the ‘FIRE number’, which is usually 25 times your yearly spending. Once that target corpus is reached, you can safely withdraw about 4% annually to cover your costs.

For instance, if your annual expenses are ₹10 lakh, you will need ₹2.5 crore to achieve FIRE. Achieving this goal requires consistent savings, a well-diversified investment portfolio, and long-term retirement planning.

In India, many FIRE movement followers invest in a mix of equities and mutual funds. They carry out research to find the best retirement plans that can ensure post-retirement stability. If managed in a prudent manner, the FIRE movement can empower individuals to create a lifestyle where work becomes optional, not necessary.

Who is FIRE For?

The ‘finance independent retire early’ philosophy appeals to a wide range of individuals, especially those seeking freedom from the traditional 9-to-5 work model.

1. Young Professionals

Individuals in their 20s and 30s can benefit most from the ‘financial independence and early retirement’ approach. By starting early, they can make use of compounding returns and lower financial obligations.

2. High-Income Earners

Those with higher earnings can allocate larger portions of their income to savings and give their FIRE journey a boost.

3. Entrepreneurs and Freelancers

FIRE provides a financial safety net and enables those working on their own time to pursue business ventures without fear of failure.

4. Minimalists

Those individuals who prefer good experiences and simplicity over luxury may find an ideal way forward in the FIRE method.

5. NRIs Planning to Return to India

NRIs who want to spend their post-retirement years living out their hobbies and passions in their homeland may well prefer the FIRE method. They can choose NRI retirement plans that provide high returns within their time horizon.

FIRE and retirement are about redefining success. It does not just mean quitting your job but building financial freedom that lets you live life on your own terms.

Types of FIRE

The FIRE movement is not one-size-fits-all. Depending on individual goals and lifestyles, FIRE can take several forms:

1. Lean FIRE

Individuals embrace a minimalist lifestyle and require a smaller savings corpus to retire early. By maintaining a low value of living expenses, Lean FIRE advocates can achieve financial independence on a modest budget.

Example: Someone who spends only ₹25,000 per month may need a FIRE number of ₹75 lakh (₹25,000 x 12 months x 25).

2. Fat FIRE

Individuals aim for early retirement without sacrificing a higher standard of living. This approach requires building a larger corpus to sustain a more comfortable lifestyle post-retirement.

Example: A person with monthly expenses of ₹1,00,000 would need a FIRE number of ₹3 crore.

3. Barista FIRE

Individuals achieve enough savings to cover most expenses but work part-time (such as a barista job) to fill financial gaps or maintain engagement. Barista FIRE combines partial financial independence with part-time work.

Example: Someone might save enough to cover 70% of expenses and work part-time to cover the remaining 30%.

4. Coast FIRE

Individuals save aggressively in their younger years and then stop contributing while letting their investments grow until retirement. Coast FIRE focuses on investing early and allowing compound interest to grow wealth over time.

Example: A person who saves heavily in their 20s and 30s may reach a point where their investments will grow enough to fund retirement without additional contributions.

5. Slow FIRE

Instead of aggressively saving, individuals strike a balance between financial goals and present-day spending. Slow FIRE is for those who want to reach financial independence at a more gradual pace while still enjoying life along the way.

Example: A person saving 30-40% of their income rather than 50-70% may retire later than Lean FIRE enthusiasts but still earlier than the conventional retirement age.

6. Flamingo FIRE

Individuals save enough to semi-retire early and then continue working part-time or on passion projects while their investments grow. Flamingo FIRE is a hybrid approach.

Example: Someone who reaches 50-60% of their FIRE number might transition into part-time work, knowing their investments will continue compounding to full FIRE status over time.

Each approach offers flexibility, allowing individuals to tailor the FIRE method to their personal preferences and goals. Ultimately, the FIRE movement can empower individuals to break free from traditional norms and design a life aligned with their values.

Benefits of the FIRE Method

The FIRE movement offers numerous advantages, including:

1. Financial Freedom

Achieving FIRE can allow you to live life on your terms. Without the constraints of traditional employment, you can focus on passions, hobbies, or entrepreneurial ventures.

2. Early Retirement

FIRE can enable individuals to retire decades earlier than the conventional retirement age, giving them more time to enjoy life.

3. Flexibility

FIRE can provide flexibility in choosing how to spend your time and money, whether it’s traveling, volunteering, or pursuing creative endeavours.

4. Security Against Uncertainty

Building a substantial financial cushion can protect against economic downturns, job loss, or other uncertainties.

5. Improved Mental Well-Being

Financial independence can reduce stress related to money, allowing individuals to focus on their personal growth and happiness.

6. Pursuance of Dreams

FIRE allows individuals to spend time on their dreams and goals, whether it’s starting a business, writing a book, or traveling the world without worrying about finances.

With dedication, financial literacy, and a clear plan, FIRE can become more than just a concept—it can become your reality.

Steps to Achieve FIRE

Achieving FIRE requires careful planning and disciplined execution.

Here are the key steps to get started:

Step 1. Calculate Your FIRE Number

Your FIRE number is the amount of savings needed to retire early. Use a pension calculator or the 4% rule to estimate your target.

Example: If your annual expenses are ₹12,00,000, your FIRE number would be ₹3 crore (₹12,00,000 x 25).

Knowing your FIRE number provides a clear savings target and helps you track progress toward financial independence.

Step 2. Adopt Aggressive Saving Strategies

To reach your FIRE number quickly, aim to save 50-70% of your income.

This may involve:

- Reducing discretionary spending (e.g., dining out, subscriptions).

- Downsizing your living arrangements.

- Maximizing income through side hustles or promotions.

Step 3. Invest in Diversified Portfolios

Investing is critical to growing your savings. A well-diversified portfolio might include:

- Stocks: High-growth potential over the long term.

- Index Funds: Low-cost and diversified options.

- Real Estate: Generation of rental income, along with appreciation.

- Pension Schemes: Contributions to retirement-focused plans for tax benefits and long-term security.**

Step 4. Minimize Expenses with a Minimalist Lifestyle

Adopting a minimalist lifestyle reduces unnecessary expenditures, helping you save more. Focus on value-driven spending that aligns with your priorities.

Example: Cooking at home instead of dining out or using public transport instead of owning a car.

Step 5. Plan for Contingencies

While pursuing FIRE, it’s essential to prepare for unexpected events. Investing in life insurance can provide financial security for your loved ones in case of emergencies. Additionally, maintaining an emergency fund could ensure that you can handle unforeseen expenses without dipping into your investments.

Step 6. Regularly Monitor and Adjust Your Plan

As market conditions and personal circumstances change, it’s crucial to revisit your FIRE plan. Rebalance your investment portfolio and adjust your savings rate as needed to stay on track.

Step 7. Leverage Tools for Simplicity

Use financial tools such as pension calculators and budget apps to simplify tracking and projections. These tools can help identify gaps and refine strategies.

Applying the FIRE Formula to Indian Finances

In the Indian context, the FIRE movement must adapt to factors such as inflation, taxes, and changing lifestyle costs.

- The 4% withdrawal rule used in Western countries may not always be directly applicable, due to higher living cost fluctuations in India. Instead, it may be a wiser idea to have a 3–3.5% safe withdrawal rate for sustainable retirement income.

- To apply the FIRE method and retire early successfully in India, focus on consistent SIPs in mutual funds, contributions to pension plans, and opting for tax-saving tools.

- It is also recommended to be aware of how your post-retirement income may be taxed by looking at current taxation trends. Choosing tax-efficient tools will not only help you avoid tax on your future income but also allow you to enjoy tax deductions against your current contributions.

- Using a retirement calculator can help you evaluate the future value of your corpus and adjust contributions accordingly. Including assets like real estate and gold can help diversify your strategy and provide protection against inflation.

- With discipline and proper retirement planning, Indian investors can achieve FIRE in a way that is in sync with local conditions and their long-term financial goals.

How To Find and Refine Your FIRE Number

Your FIRE number determines the total amount needed to achieve financial independence and early retirement. It is calculated by multiplying your annual expenses by 25 (based on the 4% rule). However, this formula should be adjusted to match inflation, changing lifestyle needs, and evolving financial goals. It should be customised according to your needs.

To refine your FIRE number:

Step 1. Calculate Core Expenses: Include essentials such as housing, healthcare, utilities, and daily costs.

Step 2. Add Lifestyle Goals: Factor in travel, hobbies, and future plans, to create a realistic figure.

Step 3. Adjust for Inflation: India’s inflation rate can range between 5–6%, so your corpus should grow with that in mind.

Step 4. Include Contingencies: Keep a 10-15% buffer for emergencies or market fluctuations.

Step 5. Use a Retirement Calculator: An online retirement calculator helps you track your progress and simulate investment growth. It can help you determine if you are on track to achieve FIRE and retire early.

By refining this number at periodic intervals, you stay aligned with your financial targets. You also ensure your investments keep pace with both personal and economic changes.

Using Early Retirement Tools

Several tools can simplify your ‘financial independence and early retirement’ journey. Pension and retirement calculators, budgeting apps, and expense trackers help you visualise your path toward early financial independence. These digital tools make it easier to adjust your savings and investments as your financial situation evolves.

Understanding your FIRE Age

Your FIRE age, i.e., the age at which you can achieve financial independence and retire early, is influenced by how much you save, invest, and spend. Simply put, the less you spend and the more efficiently you invest, the sooner you can reach FIRE in your retirement.

Managing and Reducing Expenses

Reducing unnecessary expenses is one of the most effective ways to achieve FIRE and retirement sooner. Start by tracking your monthly spending and identifying non-essential areas where you can save. For example, someone with ₹50,000 monthly expenses will need a much smaller retirement corpus than someone spending ₹1 lakh. Adopting a frugal yet comfortable lifestyle can lower your FIRE number and shorten your journey to financial freedom.

Making Strategic Investments

Investing wisely is important because it will help your money earn more money on its own. It is recommended to build a diversified portfolio with a mix of equities, debt instruments, and pension products. You can also include a commuted pension option for liquidity in case of major expenses, even as long-term stability is maintained. Using a retirement calculator can help estimate how your savings and returns align with your FIRE goals. So, you can fine-tune your plan for financial independence and lifelong security.

Role of Pension Plans in FIRE Method**

Pension plans could play a pivotal role in achieving the Financial Independence Retire Early (FIRE) goals, offering a reliable income stream in retirement:

- Traditional employment often accompanies pension benefits. Individuals on the FIRE path should consider integrating these plans into their broader financial strategy. By maximizing contributions to pension plans, they can benefit from tax advantages and compounding growth, which contribute significantly to reaching financial independence. Having a commuted pension option is also highly recommended for liquidity purposes.

- Life insurance plans can contribute within the FIRE framework. It can provide a safety net for dependents and additional leverage in financial planning. For those pursuing FIRE, a life insurance policy with a cash value component, such as whole or universal life insurance, can serve as both a protection measure and a savings vehicle. This cash value can be tapped into if necessary, providing liquidity while preserving other investments intended for early retirement.

- Life insurance can ensure that dependents are financially secure in the event of unforeseen circumstances. It can allow individuals to pursue FIRE without the worry of leaving their loved ones unprotected. This integration of life insurance can reduce financial risk, enabling a smoother transition to an early retirement.

By aligning pension plans and life insurance with their FIRE strategy, individuals can cultivate a robust, diversified portfolio that enhances both security and flexibility.

Challenges of the FIRE Method

While the FIRE movement is inspiring, it comes with its own set of challenges:

1. Discipline and Sacrifices

Saving 50-70% of your income requires significant lifestyle adjustments, which may feel restrictive for some.

2. Market Risks

FIRE relies heavily on investments, making it vulnerable to market fluctuations. A major downturn can impact your savings and delay financial independence.

3. Balancing Minimalism with Personal Needs

Adopting a minimalist lifestyle may conflict with personal or social expectations. Striking a balance between saving and enjoying life can be challenging.

4. Healthcare Costs

Retiring early could mean losing employer-sponsored health benefits. It could require individuals to separately plan for their healthcare expenses.

5. Longevity Risk

Retiring early could increase the risk of outliving your savings. Proper planning is essential to ensure your corpus lasts throughout retirement.

6. Cost Inflation and Lifestyle Inflation

Inflation erodes purchasing power over time, and lifestyle inflation—where spending increases with income—could derail FIRE goals if not managed effectively.

Insurance Coverage & FIRE

Saving and investing are important parts of the FIRE movement, but having the right insurance cover is just as essential.

Why Insurance is Important

Insurance protects you from unexpected events that can disrupt your ‘financial independence retire early’ plan. Without it, a single medical emergency or accident could force you to dip into your savings meant for early retirement.

Getting Started

Start by getting a good health insurance policy. It helps pay for hospital expenses and keeps your savings safe. Next, a term life insurance plan ensures that your family remains financially secure even if something happens to you. You can also consider accident insurance, which provides income support if you cannot work due to an accidental injury.

Going the Extra Mile

In addition to insurance, pension and annuity plans can help you create the best retirement plans and allow you to receive a regular income after retirement. Together, insurance and retirement products create a strong safety net that supports your FIRE and retirement journey, so that you can stay financially independent and worry-free throughout life.

The Financial Independence Retire Early (FIRE) method can be a transformative approach to achieving financial freedom and retiring on your own terms. While the journey to FIRE demands discipline and careful planning, the rewards—financial freedom, early retirement, and peace of mind—make it worthwhile. By leveraging online tools, such as pension calculators, exploring pension schemes, and securing your future with life insurance, you can tailor the FIRE method to your unique goals and aspirations.

Whether you choose Lean FIRE, Fat FIRE, or any other type, the path to financial independence is within reach for those willing to take the first step. It’s a commitment to designing a life that’s financially secure, purpose-driven, and deeply fulfilling.

** Tax exemptions are as per applicable tax laws from time to time.