A life insurance policy is the best financial protection plan as it offers several benefits.

Financial security: If you purchase a sizeable life cover, it will be paid as a lump sum death benefit to your dependants, in case of your accidental death. This can help them live comfortably, especially if they do not have a source of income and have young children or aging parents.

Wealth creation: Some life insurance plans offer the double benefit of investment plus insurance. The insurer invests a portion of the premium payments in equity funds to grow your funds, while the rest goes towards life cover.

Protection for every life stage: Whether it is financial security for your children's future, a steady source of income post the breadwinner's death, retirement planning or simply long-term savings, there is a life insurance policy for every need.

Tax savings: Section 80C of the Income Tax Act makes the premium payments tax-free, which reduces your taxable income. Furthermore, Section 10(10D) ensures that the pay-outs also remain tax-free. These tax laws make life insurance a worthy investment.

Retirement planning: Your work life may end, but your living expenses will still continue. A retirement life insurance policy offers coverage plus a steady source of income which can fund daily expenses, set up a small business or be reinvested in other financial instruments.

Safe investment: Financial products that offer market linked returns are subject to market volatility, which makes them risky. Life insurance, however, offers you assured benefits in exchange for premium payments.

Loan options: In case of an unexpected financial crisis, life insurance lets you borrow from the sum assured, depending on the policy terms and conditions.

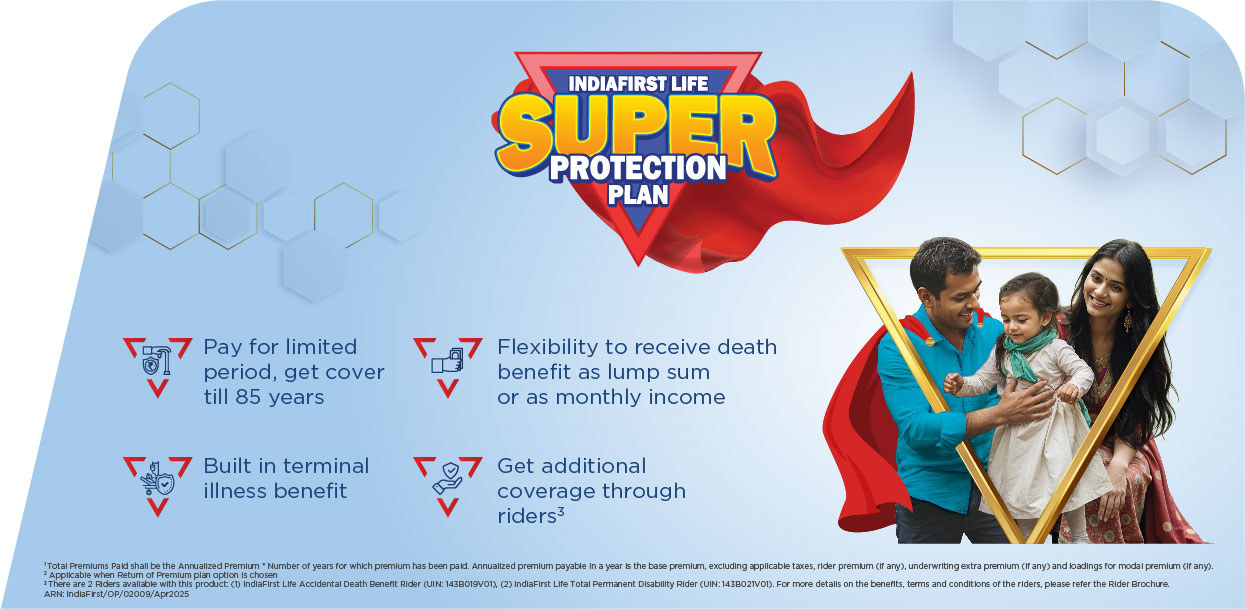

Riders: Riders are additional benefits that you can purchase to make your life insurance policy stronger. Riders protect you from uncertainties such as critical illness, accidental death, or total permanent/partial disability that can cause loss of income.