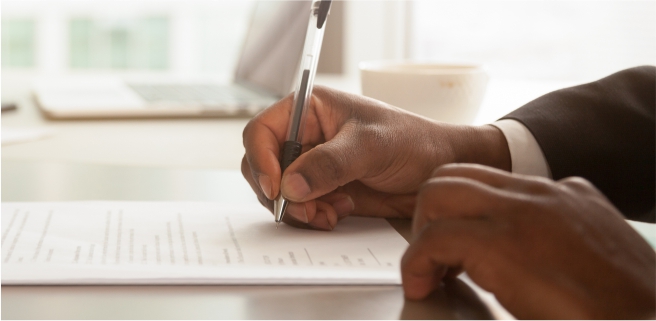

Term insurance is deemed by many to be an important addition to your financial planning strategy. A working professional taking care of their family, or someone who is considered a primary earner in the household, should have a term life insurance cover. In addition to a working professional, there a number of other types of individuals that may need a term life insurance plan or find use for them. For example, a retiree who seeks to support their child’s wedding or their dependent parent’s needs, could be a candidate for term plans.

But what about a housewife? Or a househusband? Your spouse who is not employed or earning? Is term insurance for a non-working spouse necessary? Let’s look at the need for a life cover for a non-working person.

Non-Working Spouse – A Misnomer

It is essential to broaden the definition of 'working.' As long as working is defined as productivity linked to making money, the term ‘non-working’ continues to exist. However, a non-working spouse is a misnomer.

Spouses who choose to stay at home and take care of the household have their own set of responsibilities and duties. Typically, a stay-at-home spouse can end up putting in more hours of work in a given day than those who are employed in a typical 9-to-5 setting.

Now, a term plan does not just offer income replacement benefits, but it also serves as a financial measure of human value. While a term insurance plan cannot replace the life of any individual, it can offer a monetary value that can help you financially tide over the loss of a family member. Therefore, both spouses need to have a solid term insurance plan to help protect their family members in their absence. In India, term insurance for a housewife/partner should gradually gain recognition as families begin to understand the financial value and irreplaceable contribution of a stay-at-home spouse.

Can You Buy Term Insurance for Non-working Spouses?

For financial underwriting purposes, the IRDAI (Insurance Regulatory and Development Authority of India) does not allow a non-working person with no income proof to buy term insurance for themselves. However, there is an exception to this rule—a working spouse can purchase a term plan for non-working spouse to ensure that the stay-at-home spouse has their life covered too.

Reasons Why Term Insurance Plan For Non-Working Spouse Is A Must

The idea that a non-earning spouse does not affect the family's financial bottom line is a myth. If the routine household tasks are not taken care of, it would be impossible for other family members to step out of home and earn a living. Both aspects of life—at home and work—need to be balanced, which is only possible with the contribution of the stay-at-home spouse.

As is the case with most homes in India, it is likely that the working spouse in your household has life cover in the form of a term plan while the non-working spouse has no coverage. This unfortunate insurance situation should be addressed immediately with a term plan for non-working spouse.

A well-structured term insurance plan for spouses can provide peace of mind for the entire family, ensuring that no partner is left financially unprotected.

Planning for family security

Buying a term insurance plan is not about the policyholder's needs. Instead, a term insurance plan addresses the family's financial needs in the future. Ergo, a term plan serves to fulfil the lacuna that the loss of a specific person creates. For instance, if a working member of the family dies, the payout from their term plan would replace the monthly income loss or provide a lump sum to meet the financial needs of the family members.

What are the needs created in the case of the death of a non-working spouse? From childcare and teaching children to overall household management, a non-working spouse gets through a lot of work on any given day. What's more, a non-working spouse does not get to take breaks or a holiday from any of their responsibilities. In fact, a holiday for a working spouse typically leads to more work for the non-working one.

The loss of a non-working spouse shakes the very foundation of any home. While you cannot compensate for the emotional pain and loss of a loved spouse, it is essential to factor in what your family would need and how much your financial burden will increase without the existence of your spouse.

At this juncture, a term plan for non-working spouse can go a long way to ensure that your drastically increased financial expenses are covered in case of their untimely death. Regardless of whether one is working for wages or not, a term insurance plan for non-working spouse is a must to ensure the financial security of family members in their absence.

Planning for any eventuality

A term plan for non-working spouse helps you plan for any eventuality with the help of suitable riders. For example, the base coverage provided by a term insurance plan ensures that your family members receive a pay out in case of the policyholder's death.

But what happens if the policyholder suffers an accident or a disability? By adding riders such as an accidental death benefit rider, accidental total or partial disability rider, and critical illness rider, you can ensure that your family is adequately provided for in any eventuality.

Since the loss of limb or diagnosis of critical illness of a non-working spouse is likely to be just as devastating to the household as that of the earning member, a term plan for non-working spouse with suitable riders is a must.

Benefits Of Getting A Term Insurance Plan For Non-Working Spouse

Besides the financial security of your family members, there are several other benefits of purchasing a term insurance plan for non-working spouse in India.

- If you invest for your non-working spouse at an early age, the premiums would be much more affordable than when you decide to do it later.

- With some term plans for non-working spouse options, you can increase the sum assured and the protection offered at different life stages.

- The premiums you pay towards a term insurance plan for non-working spouse are eligible for tax benefits and exemptions under Section 80C and Section 10(10D) of the Income Tax Act, 1961. One may even earn tax exemptions on the benefits received from the term plan for non-working spouse as per the prevailing tax laws in the country.

Buying a term life insurance plan for non-working spouse is not an out-of-the-box move. It is simply a step towards proper financial hygiene in the 21st century. Double the security net you are offering your dependents by ensuring that both spouses are covered with term insurance policies.